I'm a Single Student Which Tax Forms Should I Use

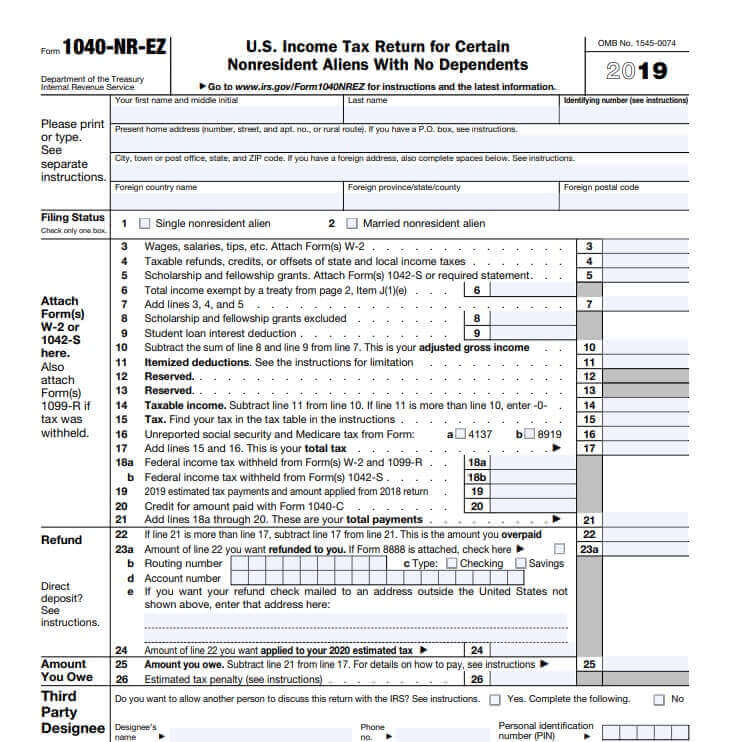

Most F-1 students are considered nonresident aliens in the US and are required to file a US tax return form 1040-NR for income from US sources. For most college students filing a tax return thats the standard Form 1040.

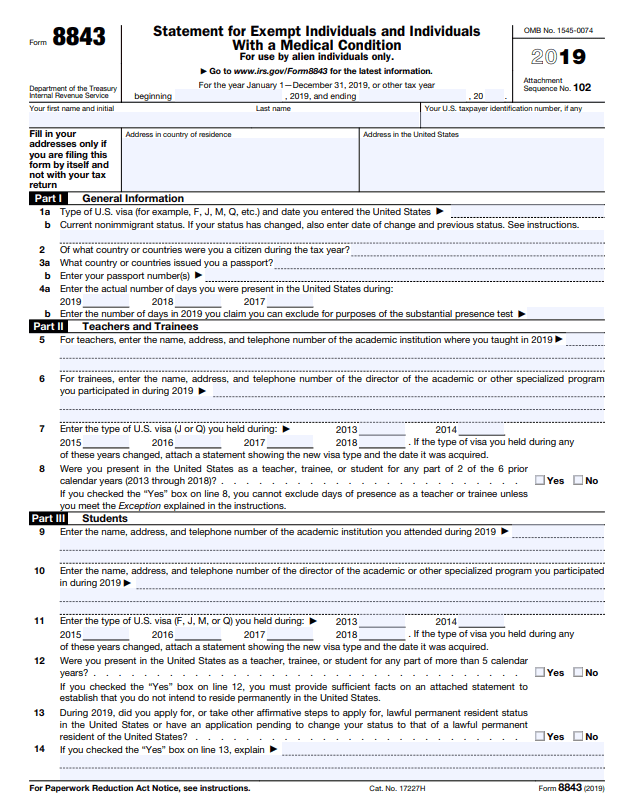

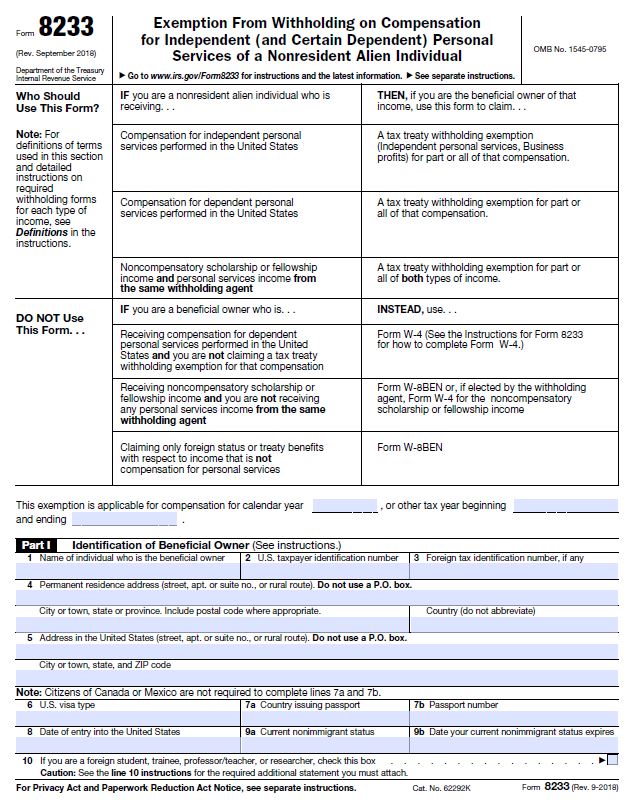

5 Us Tax Documents Every International Student Should Know

If you answered Yes to the first question you were married on December 31 then you cannot file as Single unless you were legally separated.

. But they have added most of. Instructions for Form 1040 Form W-9. You are considered temporarily away from your.

Individual Tax Return Form 1040 Instructions. POPULAR FORMS. You are not considered a resident of your college state.

Get Rid Of The Guesswork And Have Confidence Filing With Americas Leader In Taxes. Get Your Max Refund Today. Youll use this form to report your income for the year and filing status along with any deductions or.

Most students will use a form called 1040. POPULAR FORMS. If you were married and not legally separated.

Income Tax if you earn more than 1042 a month on average - this is your Personal Allowance. This interview will help you determine which form you should use to file your taxes. You can always use Form 1040 regardless of whether you qualify to use Form 1040A or 1040EZ.

The 1040A form is the next step up the tax-form ladder. Ad Free For Simple Tax Returns Only With TurboTax Free Edition. Browse discover thousands of brands.

As with Form 1040EZ the earning limit on filers wanting to use the 1040A has increased so more taxpayers should be. Get Your Max Refund Today. Starting in 2018 forms 1040A and 104EZ are no longer available to file taxes.

For tax year 2021 there are two relevant education tax benefits that you can access to reduce. The federal income tax form 1040EZ is the simplest form to use to file your federal tax return. Which IRS form to use.

Ad Free For Simple Tax Returns Only With TurboTax Free Edition. Ad File Your 1040ez Tax Form for Free. You have to pay.

Individual Tax Return Form 1040 Instructions. Request for Taxpayer Identification Number. Form 1040EZ for example is a one-page form.

By the time you fill in. Tax and National Insurance. 0 Fed 1499 State.

For 2021 Returns if a person was born during the year or before 2002 and has low taxable income - below the standard deduction amount - it might be advantageous to prepare. Instructions for Form 1040 Form W-9. This means being a student doesnt directly affect how you complete the W-4 form your.

National Insurance if you earn more than 184 a. According to the Internal Revenue Service not everyone qualifies to file with the. Decide Which Education Tax Benefits to Use on Your Grad Student Tax Return.

Get Rid Of The Guesswork And Have Confidence Filing With Americas Leader In Taxes. Read customer reviews find best sellers. Ad We Support All the Common Tax Forms and Most of the Less-Used Forms.

If you file electronically the tax preparation software will determine which form you. The Internal Revenue Service doesnt have a special category for full-time or part-time students. When filing your taxes use your home address in your home state.

Request for Taxpayer Identification Number. Here are a few general guidelines on which form to use. Sprintax Forms can help you.

1040EZ Single or Married Filing Joint Under age 65 No dependents Interest income is below 400 Income or combined incomes.

How To Complete The Fafsa When Parent Didn T File Tax Return Fastweb

Fun Meme Best Memes Positivity Lettering

What Was Your Income Tax For 2019 Federal Student Aid

Student Time Planner Bundle Daily Monthly Weekly And Etsy Australia Time Planner Planner Study Planner

Us Tax For Nonresidents Explained What You Need To Know

Income Tax Task Cards Activity Financial Literacy Filing Taxes Math For Kids

How To File Taxes For Free In 2022 Money

What Tax Forms Do I Need To File Taxes Credit Karma Tax

How To Fill Out A Fafsa Without A Tax Return H R Block

What Was Your Income Tax For 2019 Federal Student Aid

:max_bytes(150000):strip_icc()/1040-SR2022-44e2ed8aefeb4c65a07f875e2b3e173f.jpeg)

Form 1040 Sr U S Tax Return For Seniors Definition

What Is A Schedule C Tax Form H R Block

5 Us Tax Documents Every International Student Should Know

Student Emergency Contact Printable Form Template Emergency Contact Form Student Information Sheet Student Information

Tax Preparation Checklist Income Tax Preparation Tax Preparation Tax Prep

:max_bytes(150000):strip_icc()/10402021-4522fd0d0a6d4ce392d3fd952db762fd.jpeg)

Form 1040 U S Individual Tax Return Definition

Comments

Post a Comment